Should I buy Real Estate or Invest in the Stock Market.

Watch the video which gives the upside as well as the downside of buying stocks or real estate.

Use the time stamps on the video to fast forward to the part you want.

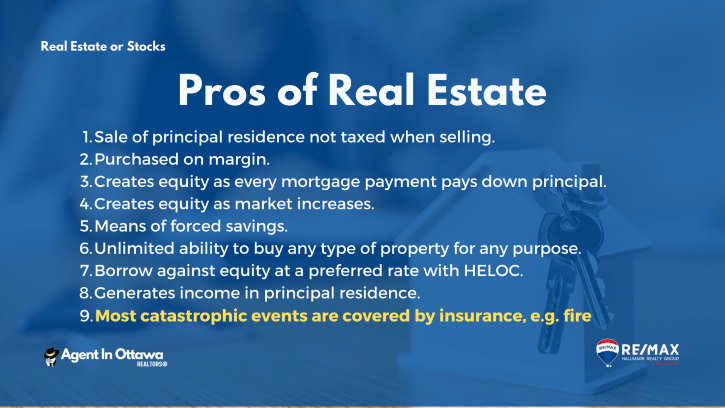

Property Ownership Pros

1. Sale of a principal residence is not taxed when selling.

2. Purchased on margin. - You don’t pay 100% of the value of the property. $600,000 house increases in value by 10% = $660,000. But if you had a down payment of 10% = $60,000, you have doubled your investment.

3. Create equity as every mortgage payment pays down the principal.

4. Create equity as the market increases.

5. Forced savings. - Many people are incapable of saving money. Spend on restaurants, trips, toys.

6. Unlimited ability to buy any type of property for any purpose.

7. Borrow against equity at a preferred rate with a HELOC. - Banks will lend you money at a lower rate because the loan is secured by the property. There is less risk to the bank.

8. Generate income even in principal residence with an SDU, Air B&B, or lodger.

9. Most catastrophic events are covered by insurance, Ie. Fire.

Property Ownership Cons

1. Annual property tax and / or monthly condo fees. - $5,000 annual property tax = $55,000 to $60,000 after 10 years. Lost money that could have been invested in equities and earned $70 or $80 thousand instead of losing $60,000.

2. One-time upfront buying closing costs about 1.75%. - land transfer taxes, legal fees, Title Insurance. - $600,000 house x 1.75% = $10,500.

3. Paying interest on a large sum of money in monthly mortgage payments. - Payment $3,455 with 10% down payment, $2,663 Interest only $788 is principal.

4. Real estate commission fees when selling, 4% to 5%.

5. Annual maintenance costs. - Ie. Broken window, replace stained bedroom carpet.

6. Intermittent infrastructure costs. - Furnace 15 to 20 years about $5,000. Shingles 15 to 20 years about $10,000 +

7. Renovate / remodel costs. - Minor Ie. Bathroom vanity, sink, faucet or painting. Want to do vs need to do like maintenance.

8. Annual landscaping. - Even inexpensively. Ie. I spend $200 - $250 buying flowers, planters, mulch. $2,500 after 10 years.

9. Annual snow removal. - $425 about $5,000 after 10 years.

10. Not liquid, can take months to sell and get your cash. Prep house for sale 30 days, listed for 30 days to sell, buyer takes possession in 60 days = 4 months before get cash.

11. It’s not diversified, if the market goes down your price likely goes down.

12. Pay Capital Gains tax of 50% when selling an investment property.

Financial Market Investments Pros

1. No annual maintenance / reno costs.

2. Minimal or no cost to purchase.

3. Pays you interest / dividends monthly or quarterly.

4. Mitigate paying taxes now or in the future. • TFSA pay no taxes when withdraw. - Buy $88,000 since inception 2009 and it’s now $200,000 and you withdraw, there are NO taxes to be paid on that $200,000. • RRSP reduce taxes when buying.

5. Liquid asset, buy or sell withing minutes. - Either with your advisor or yourself online with a program called Questrade.

6. Buy and forget, occasional rebalancing. - don’t have to do frequent maintenance. May change percentage of stocks to bonds or buy GIC’s if warranted.

7. Risk diversification. Buy different asset classes Ie. Tech or REITS, stocks or bonds. - Stocks and bonds work in opposition to each other, so if you own both you can mitigate losses when markets decline. Buyer “blue chip” stocks like Apple or P&G.

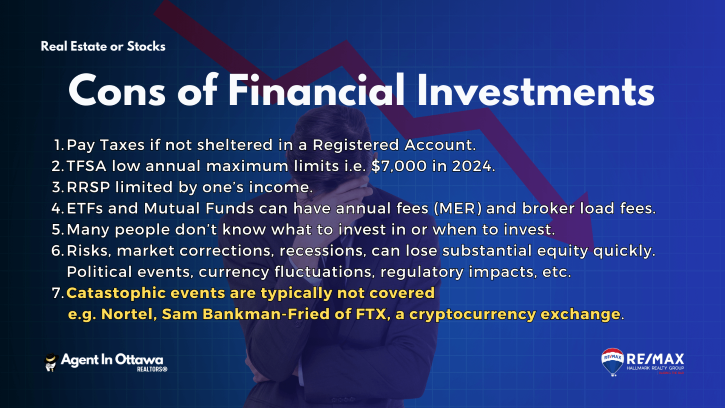

Financial Market Investments Cons

1. Pay taxes if not sheltered in a Registered account.

2. TFSA low annual maximum limits. ($7,000 in 2024) -If you have cash to buy more, you can’t do so.

3. RRSP limited by one’s income.

4. ETF’s and Mutual Funds can have annual fees called MER and broker load fees. - 1/4% to 3%.

5. Many people don’t know what to invest in or when to invest. Warren Buffet said buy what mimics the S&P 500 when you have the money.

6. Risks, markets correct, recessions happen, possible to lose substantial equity quickly. political events, currency fluctuations, regulatory, etc. - Many find this stressful and sell when markets go into decline.

7. Catastrophic events typically not covered Ie. Nortel, Sam Bankman Fried of FTX, a cryptocurrency exchange. - Generally your cash is gone for good. No so with a house or even if it burns down there is still land value.

If you have decided that you want to invest in Stocks, talk to a financial advisor who specializes in them, and if you want to invest in real estate in the Ottawa area, start here, check out current listings of Income Properties.

Multifamily Homes for Sale across Ottawa